I’ve finally taken decisive action: my old burdens are history, and I am now officially fund-free. It’s time to share my experiences and provide insights into my decision-making process in portfolio optimization through a fund-free investment strategy.

The Old Burdens: A Retrospective

My old burdens consisted of two funds that my father acquired for me years ago. He bought them with the intention of providing me with a financial advantage. However, despite these good intentions, it’s essential to regularly reevaluate past investments. Here’s an overview of their performance:

| Fund | ISIN | Performance | Ongoing Costs |

|---|---|---|---|

| Fondak A | DE0008471012 | +197.08% | 1,70 % p.a. |

| Concentra A EUR | DE0008475005 | +21.96% | 1,80 % p.a. |

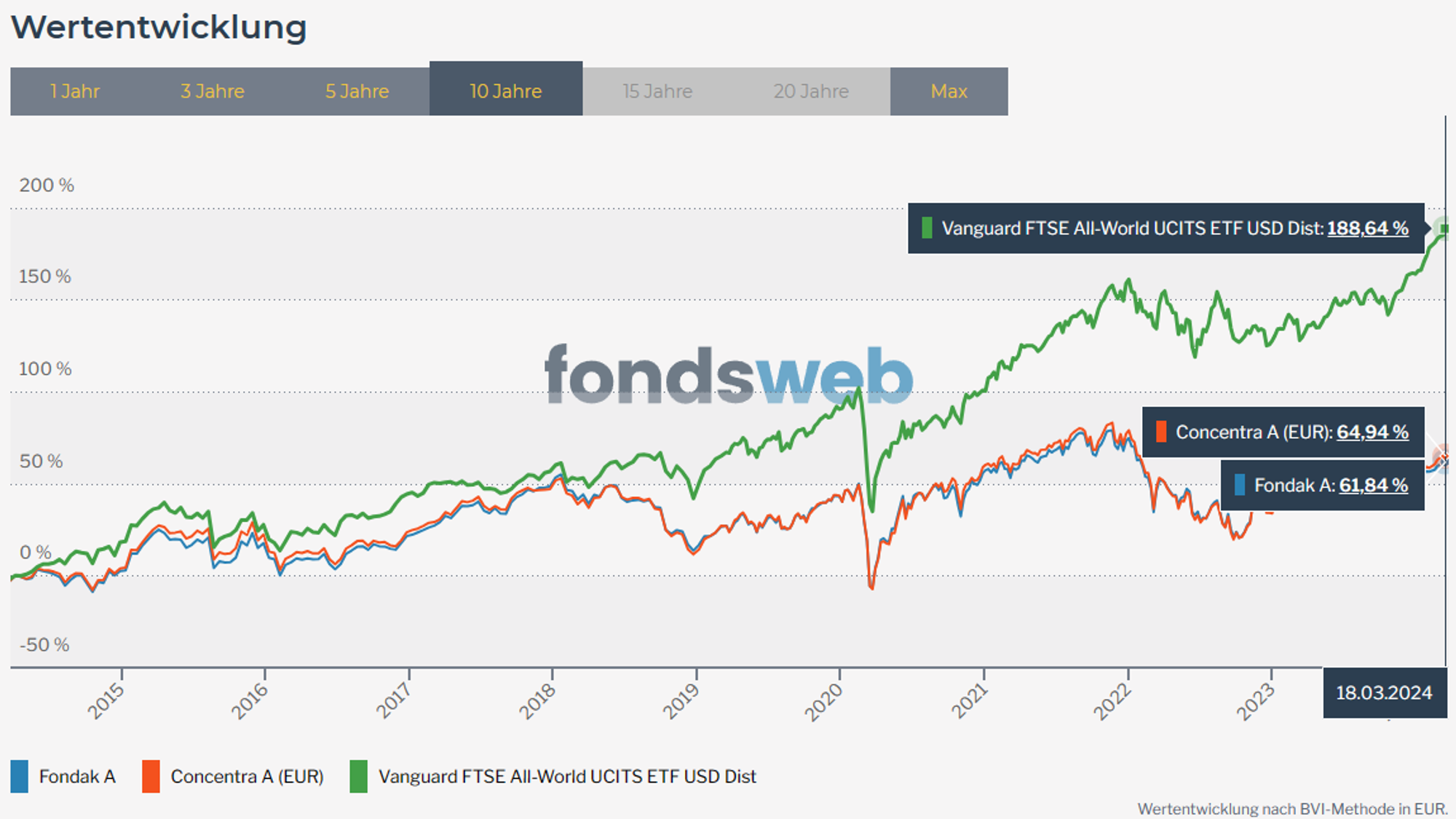

A critical look reveals quickly: both funds mainly focused on the German market, had high ongoing costs, and achieved significantly lower returns over the past years compared to the FTSE All-World.

A closer look at the performance over the last 10 years between the FTSE All-World and the two funds illustrates that they not only lagged behind the global market in the last five years but also in the long term. This highlights their inefficient and suboptimal performance compared to a broadly diversified global index like the FTSE All-World.

The Decision to Sell and Implement a Fund-Free Strategy

The negative aspects of the funds are undeniable. Apart from high costs and lack of diversification leading to below-average performance compared to global indices, they were also heavily focused on the German market. The one-sided focus increased the risk and reduced the chances of achieving adequate returns.

The decision, therefore, shouldn’t be too difficult: portfolio optimization through a fund-free investment strategy. But why hadn’t I done this before? There were several reasons for this, subjectively understandable. However, the most important one was that my father had bought these funds for me. I didn’t want to sell them without his approval, even though I owned them. However, it must be said that I wouldn’t have held onto the funds much longer even without his consent. They had long been a thorn in my side. And why not? Due to their costs, historical performance, and this “diversification,” the funds wouldn’t have stayed much longer in my portfolio anyway.

The Portfolio is Optimized – Or Is It?

So, am I finally fund-free? Unfortunately, no. Even though I may have suggested so earlier, I still own 2.056 shares of Fondak A in my portfolio. But before any alarm bells start ringing about why I still have them despite acknowledging them as not good investments, I can reassure you. When I started my first job, it offered employee savings plans. At just 18 years old and fresh out of high school, I listened to my father and set up a savings plan for the Fondak A fund. This money is tied up for several more years, and I shouldn’t sell it for now until the seven years are up. But with just a little over two units left in this fund, the burden has significantly decreased.

Conclusion: The Path to a Fund-Free Investment Strategy

This experience has shown me how important it is to regularly review my investments and adjust them as necessary. Although it’s initially challenging to detach from long-running investment strategies, opting for cost-effective and broadly diversified investments can pay off in the long run.

By selling my funds, I’ve taken an important step towards an efficient and profitable investment strategy. I will now invest the proceeds into my ETF strategy, which is diversified and will benefit long-term from global market developments.